Unconventional Profits Interest Structure Receives U.S. Tax Court Blessing

Unconventional Profits Interest Structure Receives U.S. Tax Court Blessing

The U.S. Tax Court recently issued a memorandum opinion, ES NPA Holding, LLC, et al. v. Commissioner (T.C. Memo. 2023-55), holding that a partnership did not recognize income after receiving an interest in an upper-tier partnership. Instead, the Tax Court ruled that the partnership interest was received in exchange for services and qualified as a non-taxable grant of a “profits interest” within the meaning of Rev. Proc. 93-27 (1993-2 C.B. 343).

Profitable Structures

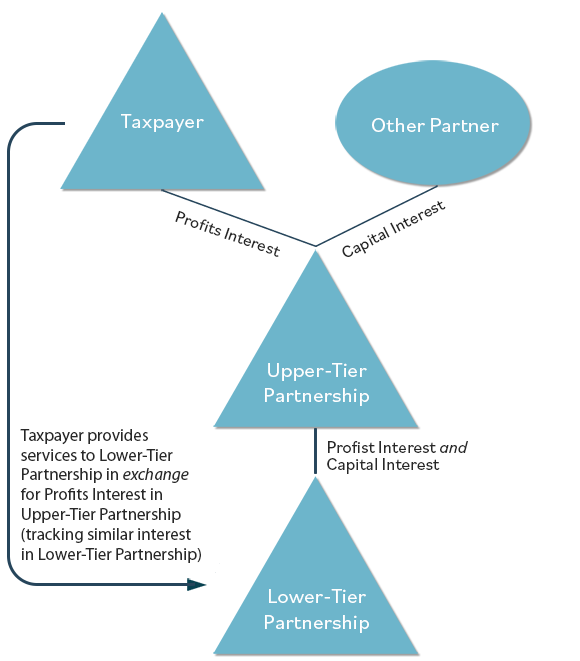

In ES NPA Holding, the taxpayer (actually a partnership for U.S. federal income tax purposes), received an interest in a lower-tier partnership through its receipt of an interest in an upper-tier partnership. Both the taxpayer and the IRS agreed that the upper-tier partnership interest was received in exchange for services provided to the lower-tier partnership. An illustration of the structure is as follows:

The IRS took the position that the grant of the upper-tier partnership interest was taxable based on two arguments: (1) Rev. Proc. 93-27 is inapplicable because the taxpayer did not provide services directly to the partnership that issued the interest (i.e. the upper-tier), and (2) that, in the alternative, the safe harbor in Rev. Proc. 93-27 is inapplicable because the taxpayer received a taxable capital interest, not a profits interest. Under Treas. Reg. Section 1.721-1(b)(1), the “receipt of a partnership capital interest in exchange for services is taxable to the service provider.”

Capital Arguments

As to the first argument, the Tax Court concluded that the taxpayer provided services to the lower-tier partnership in exchange for its interest in the upper-tier partnership. Importantly, the Tax Court also determined that the upper-tier partnership interest was economically identical to the interest held in the lower-tier partnership (i.e., the upper-tier partnership interest tracked the economics of the lower-tier partnership interest). Thus, the court found that the taxpayer’s interest in the upper-tier partnership was also a profits interest and therefore not subject to taxation under Rev. Proc. 93-27. The Tax Court noted that an alternative reading of Rev. Proc. 93-27—namely that the profits interest must be granted by the entity to which services are performed—would be unnecessarily restrictive.

The IRS also argued that the upper-tier partnership was not a profits interest—but instead a capital interest—based on a valuation conducted by its own expert witness. Rev. Proc. 93-27 and related guidance requires the issuing partnership to value itself (and its assets) so as to ensure that the profits interest would not be entitled to proceeds if the partnership were to liquidate immediately after grant. This is commonly done by setting a benchmark or distribution threshold over and above which a profits interest may participate.

As the Tax Court noted in ES NPA Holding: “an interest that would give the holder a share of the proceeds if the partnership’s assets were sold at fair market value and then the proceeds were distributed in a complete liquidation of the partnership” would constitute a capital interest. The benchmark or distribution threshold must be set high enough to avoid that result. In this case, it appears that the benchmark was set by reference to the value placed on the capital interest of the lower-tier partnership in connection with a contemporaneous purchase of such interests.

Conclusion and Important Takeaways

This opinion should provide comfort to less than plain vanilla profits interest structures provided that the terms of the partnership interest (through all partnership tiers) meet the definition of a profits interest. Such structures are commonly developed to achieve complicated economic arrangements (whether in the context of an acquisition, as here, or otherwise), to simplify incentive plan administration, and in some cases to address the IRS’ own restriction against dual employee-partner status.

The opinion also reaffirms the use of contemporaneous arms-length transactions as a means to solve one of the most difficult logistical challenges inherent to any profits interest structure—ensuring that the partnership is appropriately valued in order to prevent the profits interest from being treated as a capital interest. The Tax Court helpfully noted “actual arm’s-length sales occurring sufficiently close to the valuation date are the best evidence of value, and typically dispositive, over other valuation methods.”

Taxpayers with questions about profits interests or partnership tax issues more generally should contact Daren Shaver or the Hanson Bridgett Tax Group.

For More Information, Please Contact:

Receive legal alerts, case analysis, and event invitations.