How LLCs May Help Maximize Qualified Small Business Stock Benefits

How LLCs May Help Maximize Qualified Small Business Stock Benefits

10X Basis and LLC Conversions

Commencing business operations as an LLC does not necessarily preclude the receipt of Qualified Small Business Stock (QSBS) benefits. In fact, starting a business as an LLC may actually provide significant QSBS exclusion benefits, provided the founders and early investors meet various requirements. This alert provides a brief review of how LLCs can generate QSBS benefits while considering the potential drawbacks of using an LLC to obtain a tax exclusion under the QSBS rules.

General Formation Considerations

In general, IRC Section 1202(b) allows a shareholder who invests in certain types of startup businesses to exclude up to $10 million of gain or 10 times (“10X”) the shareholder’s basis in the stock. Typically, for founders who form a C corporation and make a small capital contribution in exchange for their restricted stock, the $10 million exclusion is the only available benefit (with potential trust stacking). But IRC section 1202(i)(1)(B) stipulates that when a taxpayer contributes property to a QSBS-eligible corporation (or converts an LLC to a corporation), “the basis of such stock in the hands of the taxpayer shall in no event be less than the fair market value of the property exchanged.”

In other words, if a founder converts an LLC to a C corporation, her basis for purposes of the 10X test is set at the fair market value of the LLC immediately before conversion. This gratuitous basis step-up can provide a huge potential exclusion for founders without the need to stack QSBS through gifts and trusts.

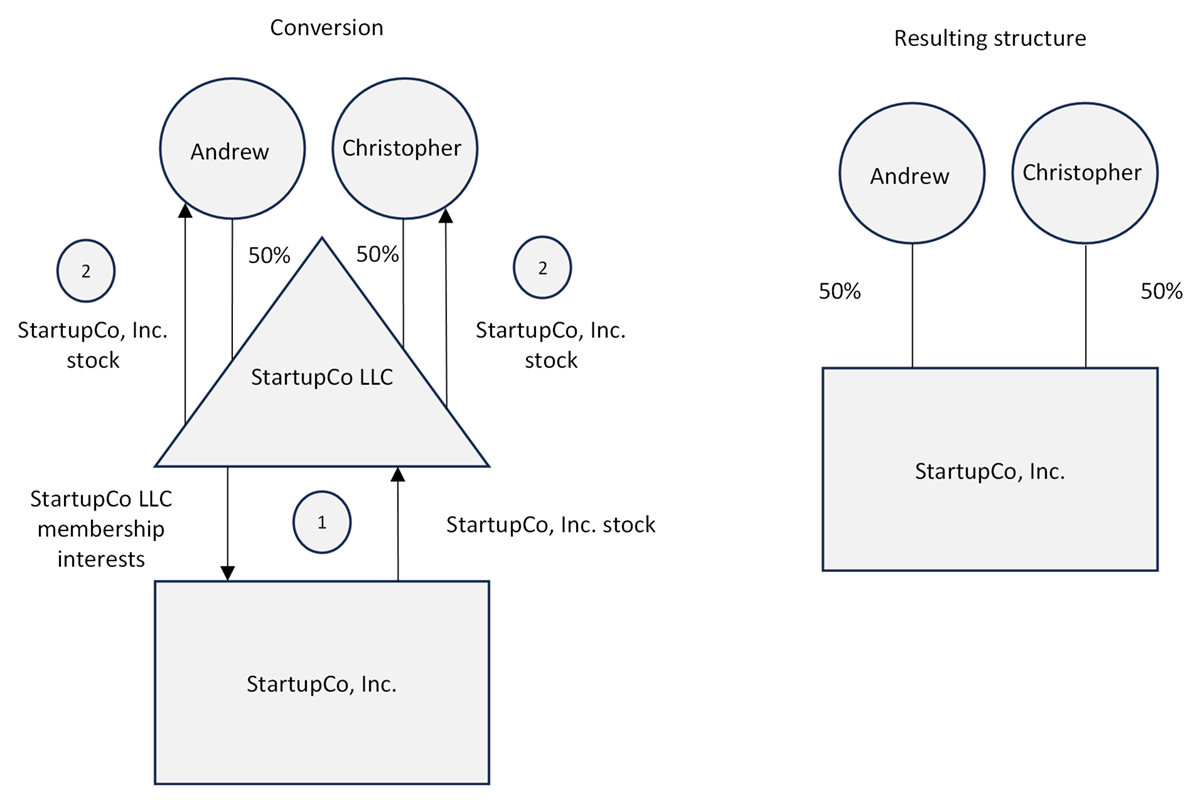

Example: In January 2015, Andrew and Christopher formed StartupCo LLC, which is taxed as a partnership, each holding a 50% interest. In January 2017, Andrew and Christopher decide to convert the business into a C corporation when the LLC is valued at $12 million (with their respective LLC interests valued at $6 million each). In connection with the conversion, they each contribute their LLC interests into the newly formed StartupCo, Inc., receive C corporation stock, and liquidate the LLC. By virtue of the conversion, Andrew and Christopher receive QSBS and would each be eligible to exclude gain up to 10X their basis in the shares, or $60 million each, assuming their shares satisfy the other QSBS requirements.

By forming their startup as an LLC and waiting to convert when the LLC is worth $12 million, Andrew and Christopher have created significant gain exclusion through the 10X basis route, without the need to transfer their shares into nongrantor trusts or similar stacking vehicles.

Potential LLC Structuring Considerations

While the conversion to corporate form may provide potentially significant future QSBS benefits through the 10X basis exclusion, founders need to carefully consider the risks and rewards of pursuing such a strategy.

First, when an LLC converts to a C corporation, that conversion is generally considered a tax-deferred transaction under IRC section 351, and any built-in gain in the LLC will be recognized when the C corporation is sold. In the case of Andrew and Christopher’s StartupCo, they can exclude $120 million of gain when they sell their QSBS. But at that time, they have to recognize $12 million of gain, representing the appreciation of value in the LLC between January 2015 and January 2017 (so they each can effectively exclude $54 million: $60 million - $6 million).

Second, practitioners generally agree that the QSBS five-year holding period commences at the time the LLC converts, not at the LLC formation date.1 So, Andrew and Christopher would have to hold their shares of StartupCo, Inc. stock from January 2017 until January 2022, resulting in a seven-year investment (with the initial two years as an LLC). For founders with adequate runway, the additional LLC holding period may not create an issue for the five-year QSBS exclusion clock. However, for founders who expect their startup to grow rapidly for a sale, the additional LLC holding period may prevent them from meeting the required holding period.

Third, founders must exercise caution regarding the value of the LLC at conversion. Generally, IRC section 1202(d) provides that a corporation cannot issue QSBS when its cash and the aggregate adjusted bases of its assets exceed $50 million. But IRC section 1202(d)(2)(B) states that, for purposes of the $50 million test, the adjusted basis of any property contributed to a corporation is “determined as if the basis of the property…were equal to its fair market value as of the time of such contribution.” In other words, if Andrew and Christopher’s LLC is valued at greater than $50 million at the time they convert the entity, the shares they are issued will not be QSBS because the new C corporation already fails the $50 million aggregate gross assets test.

Ideally, founders can obtain contemporaneous documentation regarding the value of their LLC at conversion. For example, in January 2017, when Andrew and Christopher converted StartupCo, they should have obtained a detailed valuation report showing the LLC’s value at $12 million. Even better, Andrew and Christopher could have elected to convert StartupCo to a C corporation only after the venture capitalists pledged to invest following conversion. For example, a term sheet, showing the VCs would invest $4 million on a $12 million pre-money value following conversion, is strong evidence of fair market value and helps demonstrate Andrew and Christopher’s basis for purposes of the 10X calculation.

Finally, founders should properly consider the additional tax and administrative burdens of operating as a C corporation. C corporations are subject to corporate tax while LLCs are not. Similarly, LLCs have significant flexibility in issuing different classes of units and profit interests. Corporations are more limited in their ability to incentivize employees and the C corporation’s option exercises can create a meaningful tax burden for early employees. Of course, traditional startups seeking venture capital will need to convert to C corporation status to receive financings, so the LLC conversion may be inevitable, but hopefully at the right valuation.

1 But see a potentially alternative argument in Rev. Rul. 84-111, 1984-2 C.B. 88.

For More Information, Please Contact:

Receive legal alerts, case analysis, and event invitations.